The 85th Survey of Projects Investment in India indicates the continued domination of the private sector in the capex arena of India. The Survey also revealed healthy growth in fresh investment announcements in critical sectors like Pharma, Cement, Steel, Automobiles, Roadways, and Real Estate. Most of the key sectors have shown net gains over the pre-pandemic levels. However, the worrying factor was the noticeable contraction in fresh investment plans by the public sector units during the first nine months of the current fiscal. As a result, most of the critical infrastructure sectors, other than Roadways, saw lesser fresh investment proposals vis-à-vis pre-pandemic levels.

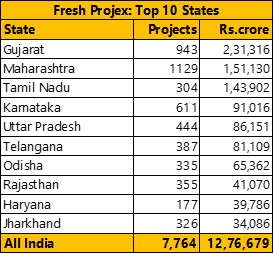

The first nine months of the fiscal year 2021-22 (i.e.Q1-Q3/FY22) saw the announcement of 7,764 new projects with a total investment commitment of Rs 12,76,679 crore. A base year (first nine months of 2020-21) comparison indicates healthy growth of 88.1 percent and when compared with the figures of the similar period of fiscal 2019-20 (pre-COVID) indicated recovery in capex activities with a healthy growth of 46.95 percent.

Projex by Ownership

As mentioned above, at present the private sector is peddling forward the capex cycle. To sustain this and to pep up the private investment further, the government has to step up its investment in infrastructure, both transport and social, on large scale.

During Q1-Q3/FY22, the Private sector announced 3,357 new projects worth Rs 8,70,463 crore and accounted for around two-thirds of the total fresh investment announced. Its share was 46.69 percent in the preceding year. Of the 203 mega projects (investment of Rs 1,000 crore or more) announced during Q1-Q3/FY22 period, 129 were by private promoters.

Private investment in the Real Estate sector increased by 43.9 percent. Anticipating increased demand for their produce from the Roadways and Real Estate sectors, Cement and Steel companies too announced large-scale capacity building plans.

In addition, step-up in capex plans were also seen in the Petrochemicals, Plastic Products, Electronics and Automobiles sectors. In the Construction sector, Real Estate witnessed sharp increase in fresh investment during April-December 2021 period.

During Q1-Q3/FY22, the public sector announced 4,407 new projects worth Rs 4,06,216.14 crore indicating a fall of 7.81 percent when compared with the fresh investment announced during April-December 2019. The fall was mainly because of the deep cut in fresh investment by state government agencies. New investment proposals announced by state government agencies during Q1-Q3/FY22 period indicated a fall of 32.74 percent when compared with the total fresh investment announced during Q1-Q3/FY20 period.

The pandemic reduced revenues and increased expenditures on healthcare and social issues. As a result, most of the state governments were left with little resources for capital expenditures. Irrigation and water supply projects were the most hit because of curtailment in capex plans.

Though fresh investment by the Central government agencies registered a healthy growth of 37.76 percent, bulk of the growth was because of the rise of investment in roadways projects. Barring this sector, all other major sectors in the infrastructure landscape registered a decline in fresh investments. A little over two-fifth of the fresh investment proposed by the government entities was in roadways projects.

Projex by Sectors

Of the five major sectors, the highest growth was seen in the Manufacturing sector followed by the Mining and the Electricity sectors. The remaining two major sectors – Infrastructure and Irrigation -- registered declines of 3.26 percent and 63.66 percent over Q1-Q3/FY20. The decline was mainly because of the contraction in capex spending by the Central and state governments.

Manufacturing

With the Private sector at the forefront in the revival of projects investment, the bulk of fresh investment is seen in the Manufacturing sector in the last two years. During the Survey period, the sector attracted 1,965 new projects worth Rs 5,27,081.15 crore.

Further, within the Manufacturing sector, sub-sectors like Petrochemicals, Refinery, Cement, Steel, Electronics and Automobiles garnered bulk of the new investment proposals.

A Rs78,000 crore petrochemicals project at Cuddalore in Tamil Nadu was the largest project in the Manufacturing sector. This was followed by the Rs 60,000 crore Green Energy Giga Complex of Reliance Industries and the Rs 34,900 crore PVC project of Adani Enterprises.

The Drugs and Pharma sector attracted 432 new projects with a total investment of Rs 17,560 crore. Of this, 382 projects were to manufacture Active Pharma Ingredients or Drug Intermediates. These projects enjoy incentives under the Production Linked Incentive (PLI) Scheme.

Anticipating increased demand for their produce from the Roadways and Real Estate sectors, cement and steel companies too announced large-scale capacity building plans. Fresh investment proposals in these two key sectors intend to add 70 million tpa of cement capacity and around 30 million tpa of steel capacity.

Apart from the Rs 18,000 crore expansion plan of Maruti Udyog, there were around one dozen projects to manufacture electric vehicles in the two-, three-, and four-wheeler segments.

Mining

Coal India and its subsidiaries accounted for two-thirds of the total fresh investment announced in the Coal Mining sector during Q1-Q3/FY22. Adani Enterprises, EMIL Mines & Minerals, Stratatech Mineral Resources, JSW Utkal Steel, MSPL, and Rungta Mines were the private players who announced mega mining projects during the survey period.

Electricity

As observed in the last two surveys, fresh investment proposals to set up non-conventional power projects (especially Solar and Wind) increased sharply in the last two years. Two mega hydel power projects announced by Greenko Energies in December 2021 and one each by Naba Power and JSW Energy in August and September 2021 respectively saw an increase in total fresh investment in the Conventional Power sector too, increasing after a dull phase in FY21. Despite this, the total fresh investment in this sector fell short of such investments observed in the first nine months of FY20 by 4.85 percent.

Non-Conventional Power projects (mostly Solar and Wind-based power projects) after dipping from Rs 54,182.96 crore in the first nine months of FY20 to Rs 22,188.33 crore in FY21, bounced back by an impressive 47.09 percent increase to Rs 79,700.30 crore during the Survey period.

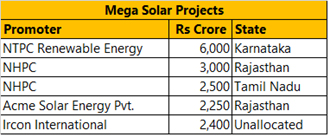

Some of the large Solar projects announced during Q1-Q3/FY22 period were:

JSW Neo Energy's Rs 25,000 crore wind-based power project in Maharashtra was the largest project announced in this sector. In all, eight new projects with an investment commitment of Rs 30,922 crore were announced in this sector.

Infrastructure

Fresh investment for development of various infrastructure projects at Rs 5,70,417 crore indicated a fall of 3.26 percent when compared with the fresh investment figures of the pre-COVID period (Q1-Q3/FY20). The decline becomes steeper at 49 percent when we exclude investments proposed in the Roadways sector.

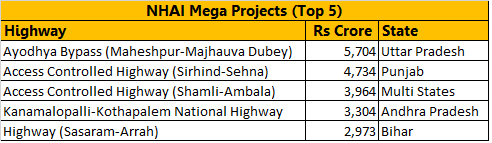

Fresh investment intentions in the Roadways sector increased impressively in the last three years from Rs 85,599 crore during Q1-Q3/FY20 to Rs 1,26,007 crore during Q1-Q3/FY21 to Rs 1,79,203 crore in Q1-Q3/FY22 periods. During the April-December 2021 period, the National Highways Authority of India (NHAI) was the biggest investor with 162 new projects worth Rs 1,11,146.69 crore.

One of the highlights of the Survey was the healthy revival seen in the Real Estate sector. With the easing of lockdown rules at the beginning of the current fiscal, real estate developers started announcing new projects. Investment in this sector started picking up from July 2021 onwards. During the Survey period, the sector saw announcement of 1,145 new projects entailing a total investment of Rs 1,19,144.21 crore (The actual number might be more as Projects Today does not monitor stand-alone projects in this sector). Compared with the investment announced in the similar period of the pre-pandemic year, this indicated a growth of 26.12 percent.

The Survey period also saw announcement of 31 new Data Centres across the country. These high-tech centres are expected to bring in fresh investment of Rs 43,873.45 crore. Fifteen of these centres are being proposed by foreign companies.

Gujarat and Tamil Nadu – Star Performers

Gujarat, mostly aided by 22 mega private projects worth Rs 1,77,007 crore, topped the state ranking table with 943 new projects worth Rs 2,31,315.7 crore. The state cornered around 18 percent of the total fresh investment emanated in the nine months ending December 2021. During Q1-Q3/FY20, the state could manage a total investment of Rs 1,53,423.76 crore.

The second-ranked Maharashtra with the highest number of 1,129 new projects garnered fresh investment of Rs 1,51,130.28 crore. The state was followed by Tamil Nadu (304 projects worth Rs 1,43,901.84 crore), Karnataka (611 projects worth Rs 91,015.98 crore), and Uttar Pradesh (444 projects worth Rs 86,151.44 crore).

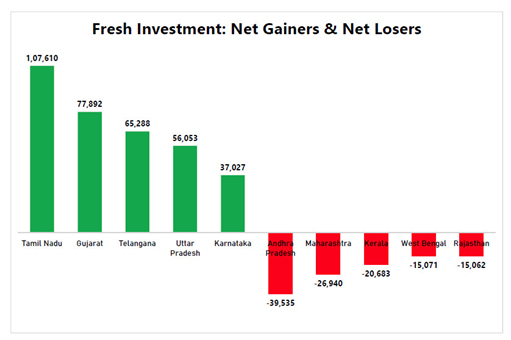

However, when the states were ranked, based on the net increase in investments they attracted during the April-December 2021 period over the figures of the April-December 2019 (pre-COVID) period, we saw some interesting changes in the rankings.

The third-ranked Tamil Nadu emerged as the highest net gainer. As a result of the concerted efforts of the state government, the state managed to attract additional fresh investments of Rs 1,07,610 crore. This included 20 mega projects. During Q1-Q3/FY20 period, the state had managed to attract Rs 36,292 crore of fresh investment.

The top-ranked Gujarat followed with a net gain of Rs 77,892 crore. Telangana, Uttar Pradesh and Karnataka followed the two toppers with net gains of Rs 65,288 crore, Rs 56,053 crore, and Rs 37,027 crore respectively.

The list of states who are yet to reach the pre-COVID levels was headed by Andhra Pradesh. The southern state registered a net loss of Rs 39,535 crore. Maharashtra, the second-ranked state in terms of total fresh investment, registered a net loss of Rs 26,940 crore. The other net losers to figure among the top five states were Kerala (Rs 20,683 crore), West Bengal (Rs 15,071 crore) and Rajasthan (Rs 15,062 crore).

Outlook

The Survey was conducted when the number of people affected by the Omicron variant of COVID-19 pandemic was hitting a high across the country. Hence, all predictions made at this point are based on the assumption that the pandemic will be reigned in within a month or two.

With most of the economic indicators showing positive growth in the recent past, Projects Today expects the revival seen in the fresh investment activities to gain pace in FY23. The healthy growth seen in the Manufacturing and Real Estate sectors is expected to continue in FY23. Similarly, we expect increased fresh investment in the Roadways sector to continue in FY23 too.

While the Private sector has shown willingness to commence the capacity building activities based on its belief in the India growth story, the government should start pump priming fresh investment in the Infrastructure sector. The government can be a little lenient on the fiscal deficit figures, at least for one more year, and replicate the investment spree seen in the Roadways sector in other critical sectors like Railways, Ports, Airports, Health and Water Supply projects. It should put the implementation of the Rs 111 lakh crore NIP projects on the priority list and execute the 7,500 odd projects in the next four to five years.

The Central government should continue its reform measures and make the investment environment more investor-friendly, which will not only allow Indian companies to materialise their capex plans faster but also entice foreign companies to consider India as one of their most preferred investment destinations.

About Projects Today

Projects Today is India’s largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.